Is Long Term Care Insurance Tax Deductible? Inside: 2024 Tax Year Updates!

Updated April 5, 2024

Long Term Care Insurance policies sold are either IRS tax-qualified or non-tax-qualified; however, most policies sold today are tax-qualified. Tax-qualified means that the insurance contracts conform to the 1996 Health Insurance Portability and Accountability Act (HIPAA) as well as IRS rules. We’ll cover more details on that in a moment.

There are several possible ways you may be able to deduct your Long Term Care Insurance premiums. One simple way is if you own a HSA or Health Savings Account.

Here are 2024 and 2023 Federal Long Term Care Insurance Federal Tax Deductible Limits

Source: https://www.irs.gov/pub/irs-drop/RP-12-41.pdf

| Taxpayer’s Age at End of Tax Year | 2024 | 2023 |

| 40 or Less | $470 | $480 |

| More than 40 but not more than 50 | $880 | $890 |

| More than 50 but not more than 60 | $1,760 | $1,790 |

| More than 60 but not more than 70 | $4,710 | $4,770 |

| More than 70 | $5,880 | $5,960 |

Finally, one advantage to getting older: better deductions!

Note that for 2024 the values actually dropped from 2023. This is uncommon but not unprecedented. The limits tend to rise over time, with an occasional “click back” due to the way the IRS calculates Long Term Care premium expense averages.

States with Tax Breaks for LTC Insurance

In addition to federal benefits, we compiled a list of the top 10 states where tax benefits exist:

- New York – 20% tax credit, up to $1,500, for qualifying LTC insurance premiums paid, with carryover and employer tax credit available.

- Maryland – One-time tax credit up to $500 per insured for LTC insurance premiums paid, with employer tax credit available.

- Montana – Deduction for qualified LTC insurance premiums, with a tax credit available based on adjusted gross income.

- Louisiana – Tax credit equal to 10% of total LTC insurance premiums paid, subject to qualifications.

- North Carolina – Tax credit equal to 15% of LTC insurance premium costs, up to $350 per policy, subject to income limits.

- Minnesota – Tax credit for lesser of 25% of premiums paid or $100 ($200 for married filing jointly).

- Mississippi – Tax credit equal to 25% of premium costs, up to $500.

- Colorado – Tax credit for lesser of $150 per policy or 25% of premiums paid, subject to income limits.

- North Dakota – Tax credit for LTC insurance premiums paid for taxpayer and/or spouse, up to $250 per taxable year.

- New Mexico – Individuals who are 65 years or older can receive a state tax credit for Long-Term care insurance premiums up to $2,800, but only if their unreimbursed medical expenses total $28,000 or more during the tax year. Additionally, there is a possible $3,000 exemption for those over 65.

Several other states offer tax benefits for long-term care insurance premiums, though the specifics vary:

- Alabama allows an itemized deduction for qualified LTC insurance premiums, subject to limitations.

- Arkansas, California, Hawaii, and Iowa allow tax deductions following federal limits.

- Idaho provides a tax deduction for LTC insurance premiums paid for the taxpayer, their dependent, or employee.

- Kentucky and Ohio offer tax deductions from adjusted gross income for LTC insurance premiums paid, with Ohio’s deduction applying to federally qualified plans.

- Maine and New Jersey allow deductions for LTC insurance premiums, subject to certain conditions.

- Missouri allows a deduction for 100% of non-reimbursed amounts paid for qualified LTC insurance premiums.

- Nebraska offers a tax deduction for Long Term Care Savings Plan contributions, subject to limits.

- Washington grants an exemption from a payroll tax for owners of LTC insurance prior to November 1, 2022.

Finally, West Virginia and Wisconsin offer deductions for LTC insurance premiums to the extent not deducted for federal income tax purposes.

Self-Employed and Small Business Long Term Care Insurance Tax Deductible

The Tax Cuts and Jobs Act (TCJA) passed in December 2017, often referred to as the Trump Tax Reform, made Long Term Care Insurance premiums even more deductible. As a business owner, you may be able to deduct 100% of your medical, dental, and qualified Long Term Care Insurance for yourself, your spouse, and your dependents if you fit into one of the following:

- You are a self-employed individual with a net profit reported on Schedule C, C-EZ, or F.

- You are a partner with net earnings from self-employment reported on Schedule K-1 (Form 1065), box 14, code A.

- You are a shareholder owning more than 2% of the outstanding stock of an S corporation with wages from the corporation reported on Form W-2.

The insurance plan must be established under your business. You may be allowed this deduction whether you paid the premiums yourself, or your partnership or S corporation paid them, and if you included the premium amounts in your gross income. Take the deduction on line 29 of Form 1040. Note in all cases, however, the amount of the LTC premium you can deduct is limited based on your age. See the table above for those limits based on your age.

Here’s a 2024 CBS Money Watch article that also provides some valuable pros and cons on the usefulness of long term care insurance

Hybrid Long Term Care Plans

Over the past few years, the proportion of people buying “hybrid” long term care insurance plans has increased dramatically.

When considering hybrid long-term care (LTC) policies, it’s important to understand that tax deductibility varies among different insurance providers. Typically, the following carriers will be able to break out their premiums and offer tax deductibility for premiums paid towards the LTC portion of the policy.

- OneAmerica Asset Care

- Securian SecureCare

- Nationwide CareMatters II

- MassMutual CareChoice

Again, this is because these companies break down the individual premiums paid for various parts of the policy, clearly distinguishing between the LTC benefits and the life insurance component. As with all things taxes, confirm these details with your CPA prior to purchasing a policy.

The reason behind this is that these companies do not provide a detailed breakdown of the premiums allocated to LTC benefits versus life insurance. Without this clear separation, the premiums paid for the LTC portion cannot be claimed as tax deductible.

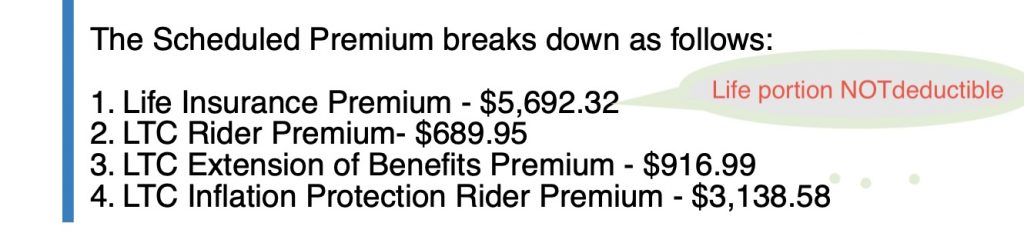

The image below illustrates the breakdown of premiums for a hypothetical hybrid LTC policy:

As shown in the image, a portion of the premium is allocated to LTC benefits, which is tax deductible, while the remaining portion is allocated to life insurance, which is not deductible. It is crucial for insurance companies to provide this level of transparency to enable policyholders to take advantage of the tax benefits associated with the LTC component of their hybrid policies.

As always, for most taxpayers, including pass through entities like S-Corps, age-based limits apply. See the table at the top of this page for the limit that applies to your particular age.

History of Tax Qualified Long Term Care Insurance

- Long Term Care Insurance policies issued before January 1, 1997, automatically qualify under the new HIPAA rule.

They are grandfathered and treated as qualified plans as long as they have been approved by the insurance commissioner of the state in which they are sold.

Policies issued on or after January 1, 1997, must meet federal standards in order to be Tax Qualified. To be a qualified Long Term Care plan, the plan must adhere to consumer-friendly rules established by the National Association of Insurance Commissioners (NAIC).

Definitions of Services and Benefit

- The policy pays benefits only for qualified LTC services. Qualified services are defined as necessary diagnostic, preventative, therapeutic, treating, mitigating and rehabilitative services, and personal care and maintenance services that are required by a “chronically ill” individual.

- The services must be provided in line with the plan of care prescribed by a licensed health-care practitioner (the insured’s doctor).

- The policy must offer buyers the choice of inflation protection and non-forfeiture protection; however, the buyer can choose not to add on these features to their Long Term Care Insurance policy.

How You Qualify

- The policy must provide that activities of daily living and cognitive impairment are both triggers to access benefits. The Long Term Care Insurance policy cannot stipulate a medical necessity trigger.

- Under an Activities of Daily Living (ADLs) benefit trigger, the Long Term Care Insurance policy must pay benefits when the insured is unable to perform at least two of six specified ADLs when certified by a licensed health practitioner and that the need for help with the ADLs is expected to continue for at least 90 days. The HIPAA rule standardized the ADLs that are to be specified in a qualified policy: eating, bathing, dressing, toileting, transferring, and maintaining continence.

- Under a cognitive impairment trigger, coverage begins when the individual has been certified as requiring substantial supervision to protect him or her from threats to health and safety.

Other Consumer Protections

- The policy must be issued as guaranteed renewable or non-cancel-able.

- The policy must include a third-party notification or other measure for lapse protection.

Long Term Care Insurance Tax Deductible, the details:

The IRS has clarified the tax treatment of Long Term Care Insurance (LTCI), and, for policy owners such as small business owners who itemize, it allows a tax deduction for premiums up to a certain limit based on one’s age.

Out-of-pocket expenses, premiums paid for qualified LTCI policies and out-of-pocket expenses for Long Term Care are tax deductible as medical expenses to the extent that the taxpayer’s total qualified medical expenses exceed 10 percent of his or her annual adjusted gross income (AGI). Note this was 7.5% prior to Obamacare.

2024 and 2023 Long Term Care Insurance Age and Premium Limitations

The deductibility of qualified LTCI premiums is limited by the age of the taxpayer (as of the end of the year), and these limits are adjusted by the IRS annually for inflation.

How do you exclude benefits received?

For information on excluding benefits you receive from a Long Term Care Insurance contract from gross income, see Publication 525.

Reviews of each company’s financial stability ratings, claims experience, and size.

Reviews of each company’s financial stability ratings, claims experience, and size. A side-by-side comparison of each company’s policy features. We cover the similarities and the differences.

A side-by-side comparison of each company’s policy features. We cover the similarities and the differences. Price comparisons customized to suit your specific needs from top carriers such as Nationwide, Thrivent, New York Life, National Guardian Life, Mutual of Omaha, and more.

Price comparisons customized to suit your specific needs from top carriers such as Nationwide, Thrivent, New York Life, National Guardian Life, Mutual of Omaha, and more.