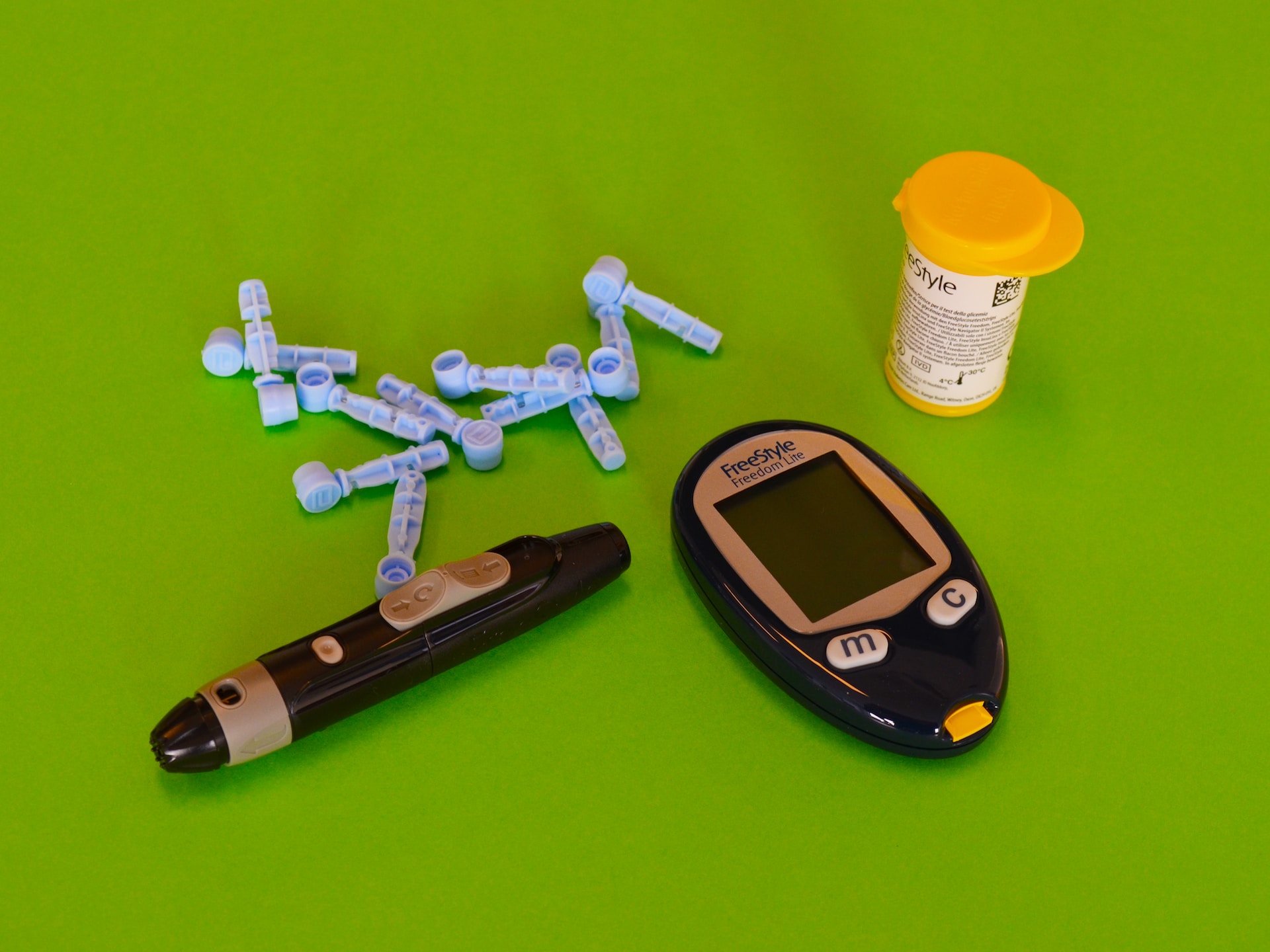

Is Alzheimer’s Type III Diabetes?

There was a recent article I read in the Express UK publication that mentioned there is growing evidence that dementia and Alzheimer’s could largely be caused by excess sugar consumption in a person’s diet. The article gives evidence that Alzheimer’s is just a continuation of diabetes, calling it Type III Diabetes.

Alzheimer’s and other forms of dementia are the leading cause of needing long term care services and having to use a long term care insurance policy if the person planned ahead and even had one. If this cutting edge theory is true, reducing the sugar consumption in our diets would be[…]

Categorical Thinking Devastates Your Future Long Term Care Planning

The sixth article in a series written by LTC Tree Advisor, Joe Houston, M.Ed., LPC, CRC Categorical thinking is the tendency to see the “general” rather than the “specific.” Rather than considering the details of a situation, these types of thinkers only get a superficial, general view. They solve a problem by summing up the situation with a simplistic generality, such as viewing the cause of America’s current unemployment problem as being caused by illegal immigration. While that may be a part of the problem, and should be considered in any programmatic solution to solve the problem, the categorical[…]

If I need Long Term Care–I’ll Just Shoot Myself

One of LTC Tree’s most senior writer was asked to offer some thoughts as to why men—more so than women—are often not receptive to the idea of long term care insurance. As a retired counselor, with many years experience dealing with many levels of folks not wanting to deal with what is usually in their best interests, I find this to be a most interesting dilemma. LTC Tree agents say that many of the men they talk to, boastfully state:

if should they should ever get to the point where they need others to take care of them, rather than[…]

Why You May Not Be Able to Buy Long Term Care Insurance

It was Spring of 1999 and I was a rookie Long Term Care Insurance agent for one of the major companies. We worked for an aggressive agency here in Atlanta that really pushed hard to get marginal cases approved. That Spring, I along with my class of agents were of course hungry for a sale as I’d spent the first six months working for free, called the “pre-agent” process. This was essentially a time period where that you were not paid unless you made a sale and would weed out the non-serious agents. I really needed to get my[…]

Give Peace of Mind This Christmas – Year End Financial Planning tips

Why do people buy Long Term Care Insurance? We set out to discuss this topic around the holidays with some year end financial planning, when many of our clients are with family and thinking about the future.

Christmas is a time of festive family gathering where we see new and old friends and of course family. You’ll see parents, grandparents, aunts and uncle who many of them may not be in such great health. It’s a time that reminds us of the cycle of life and that one day we too will be old and may need help living out our last[…]

Morningstar: Hybrid Policies Can Have Significant Drawbacks

The high cost of Long Term Care is an expense that nearly 1 in 2 people will encounter sometime during their lifetime. Given the high odds and family experiences of many baby boomers, there is tremendous interest in Long Term Care Insurance. In the past several years, insurance companies have rushed out products called “hybrids” that mix long term care benefit payments with life insurance or annuity options. The result is a guaranteed premium, often made upfront, and usually return of premium if the policy is unused. The initial appeal of this approach is obvious.

This week, morning star digs in[…]

Reviews of each company’s financial stability ratings, claims experience, and size.

Reviews of each company’s financial stability ratings, claims experience, and size. A side-by-side comparison of each company’s policy features. We cover the similarities and the differences.

A side-by-side comparison of each company’s policy features. We cover the similarities and the differences. Price comparisons customized to suit your specific needs from top carriers such as Nationwide, Thrivent, New York Life, National Guardian Life, Mutual of Omaha, and more.

Price comparisons customized to suit your specific needs from top carriers such as Nationwide, Thrivent, New York Life, National Guardian Life, Mutual of Omaha, and more.